high low method machine hours

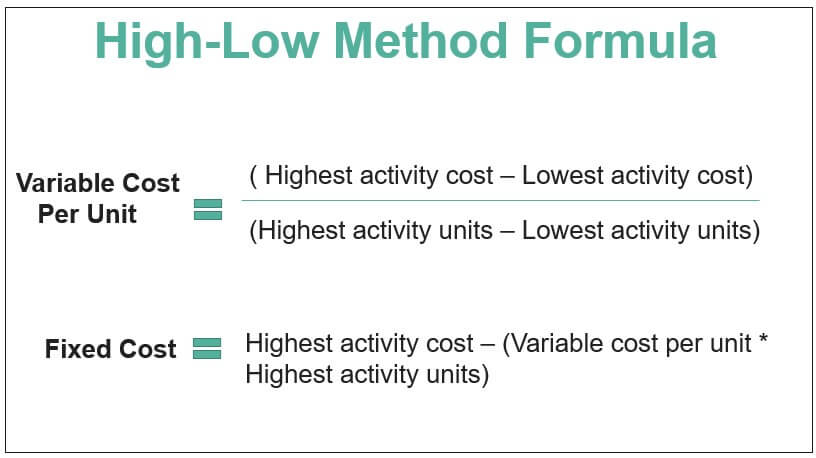

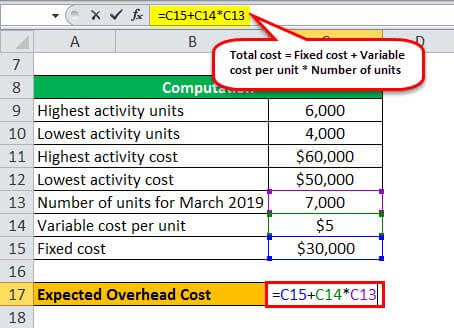

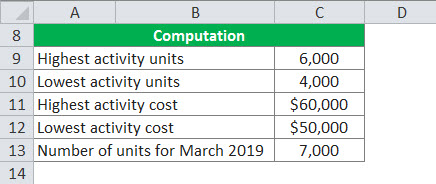

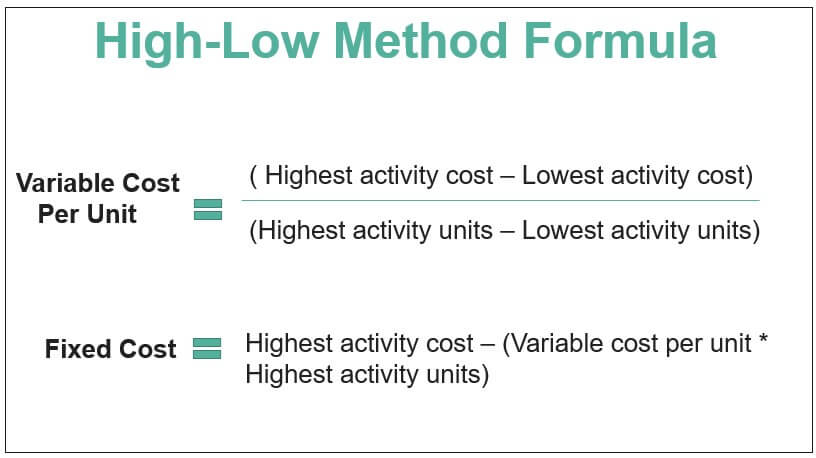

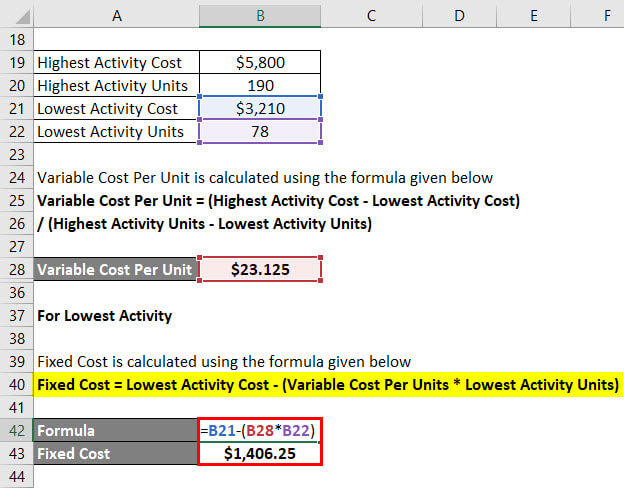

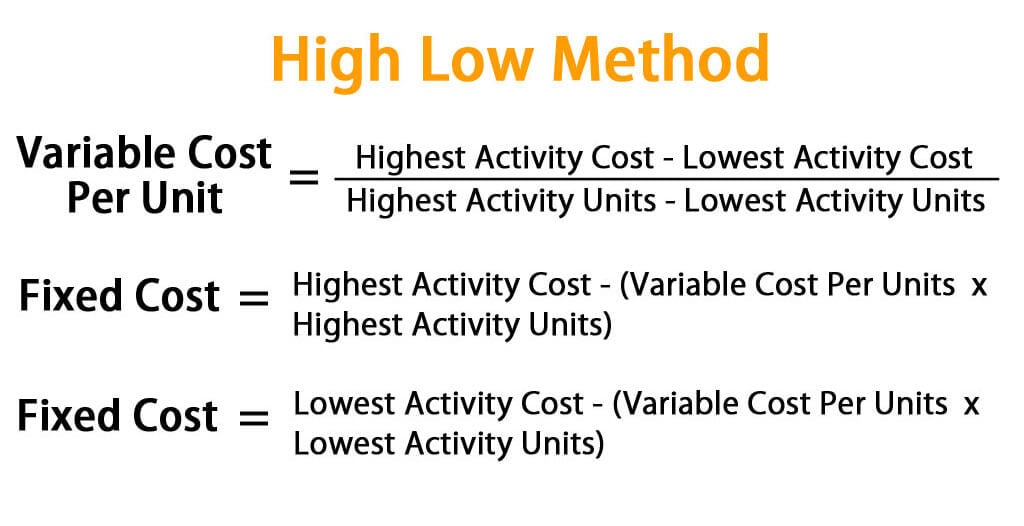

State the cost function 4. High Low Method In Accounting Definition Formula It is shown below.

Google Claims A Quantum Breakthrough That Could Change Computing The New York Times

J Jones Created Date.

. The companys relevant range of activity varies from a low of 600 machine hours to a high of 1100 machine hours with the following data being available for the first six months. Assuming these are the high and low months of activity the estimated fixed maintenance costs using the high-low method is _____. A manufacturing company estimates semi-variable costs by using the high-low method with machine hours as the cost driver.

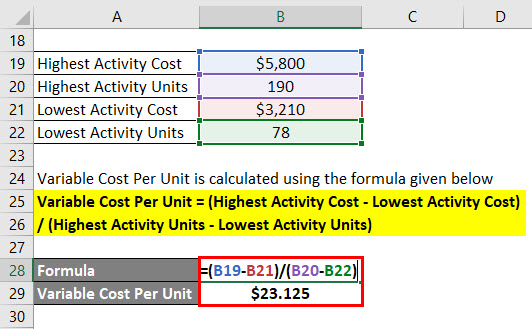

Solve Y if x 13000 machine hours. The utilities cost associated with 1110 machine hours will be 10505. 6 points Atlanta Inc which uses the high-low method to analyze cost behavior has determined that machine hours best explain the companys utilities cost.

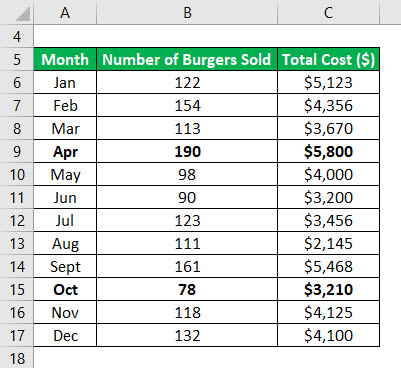

The companys relevant range of activity varies from a low of 600 machine hours to a high of 1200 machine hours with the following data being available for the first six months of the year. Machine Hours Electrical Cost January 4000 3120 February 6000 4460 March 4800 3500 April 5800 5040 May 3600 2900 June 4200 3200 Required. Month Maintenance Cost Machine Hours.

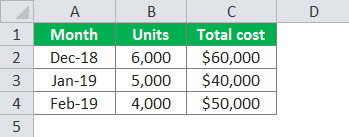

High Low method is a way to calculate the variable and fixed cost element of total cost using lowest level of activity and its cost and highest level of activity and its cost. The Month Cost Machine Hours May 8646 2650 June 11157 4000 July 11808 4350 August 10785 3800 If machine hours in October are expected to be. Based on the following information calculate fixed costs per month using the high-low method.

High Low Method of Machine Hours 8000 10000 11000 9000 14000 12000 Total Maintenance Costs 600000 640000 800000 700000 900000 870000 Required. Using the high-low method of analysis estimate the variable electrical cost per machine hour. Following past monthly cost and activity information is available.

A company incurred 12000 of maintenance cost for 6500 machine hours in June and 14250 of maintenance costs for 8000 hours in August. Now the formula for high low method is calculated. Machine Hours 22000 32000 26000 24000 Cost 56000 May June July August Oa.

The companys relevant range of activity varies from a low of 600 machine hours to a high of 1100 machine hours with the following data being available for the first six months of the year. Find the fixed cost 3. The cost function shows a positive economically plausible relationship between machine-hours and maintenance costs.

Period Semi-Variable Costs Machine Hours 1 100000 22000 2 120000 30000 3 96000 23600 If 29000 machine hours were budgeted for the next period estimated semi-variable costs would total. Barkoff Enterprises which uses the high-low method to analyze cost behavior has determined that machine hours best explain the companys utilities cost. X Company uses the high-low method to estimate total overhead costs each month with machine hours as the activity measure.

The Hunter Company uses the high-low method to estimate the cost function. Recent data are shown below. Hotlanta Inc which uses the high-low method to analyze cost behavior has determined that machine hours best explain the companys utilities cost.

Machine Hours 9000 3000 6000 Highest Lowest Difference Utility Cost 1960 880 1080 a. View high low methoddocx from BSMA 401 at STI College multiple campuses. Based on the following information calculate fixed costs per month using the high-low method.

Period Semi-Variable Costs Machine Hours 1 100000 22000 2 120000 30000 3 96000 23600 If 29000 machine hours were budgeted for the next period estimated semi-variable costs would total A. 90000 110000 130000 150000 100000 120000 140000 160000 180000 200000 220000 240000 260000 280000 300000 Machine-Hours Maintenance Costs Solution Exhibit 10-30 presents the high-low line. Use High and low method to estimate Variable cost per unit 2.

11000 76000 58000 66000. The high-low method involves taking the. Quarter Work hours Cost 1.

High Low Method is a mathematical technique used to determine the fixed and variable elements of historical costs that are partially fixed and partially variable.

High Low Method In Accounting Definition Formula

High Low Method In Accounting Definition Formula

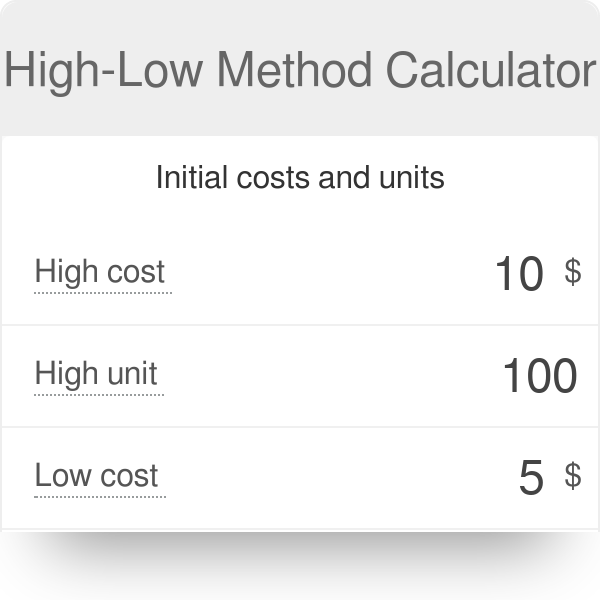

High Low Method Calculate Variable Cost Per Unit And Fixed Cost

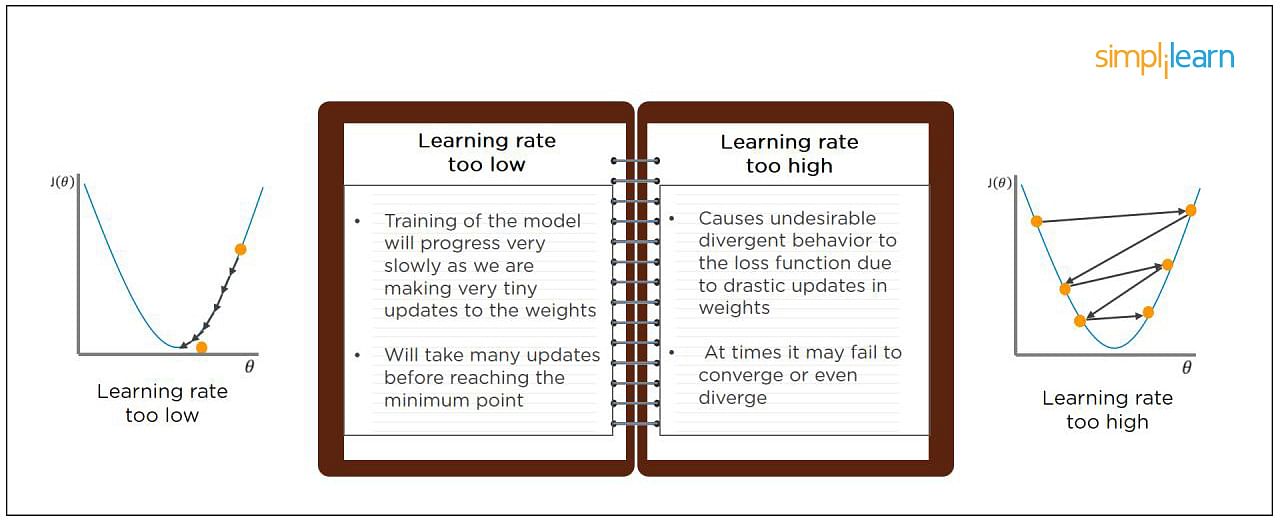

Top Deep Learning Interview Questions Answers For 2022 Simplilearn

Train Test Validation Split How To Best Practices 2022

High Low Method In Accounting Definition Formula

High Low Method In Accounting Definition Formula

High Low Method In Accounting Definition Formula

High Low Method Calculate Variable Cost Per Unit And Fixed Cost

How To Choose A Feature Selection Method For Machine Learning

High Low Method Learn How To Create A High Low Cost Model

Two Roller Flatting Machine Roller Machine

High Low Method Calculate Variable Cost Per Unit And Fixed Cost

Booster Pro2 Deep Tissue Muscle Massage Gun Cordless Therapy Vibration Body Massager 5 Heads With Low Noise For Fitness Shaping Russian Federation Au

High Low Method Calculate Variable Cost Per Unit And Fixed Cost

:max_bytes(150000):strip_icc()/Investopedia_Returnoninvestmentformula_colorv1-6d281839c5814e109e316ebbbb61a5bd.png)

/cost-accounting-b615845be6d5418e8b79152f473a902f.jpg)